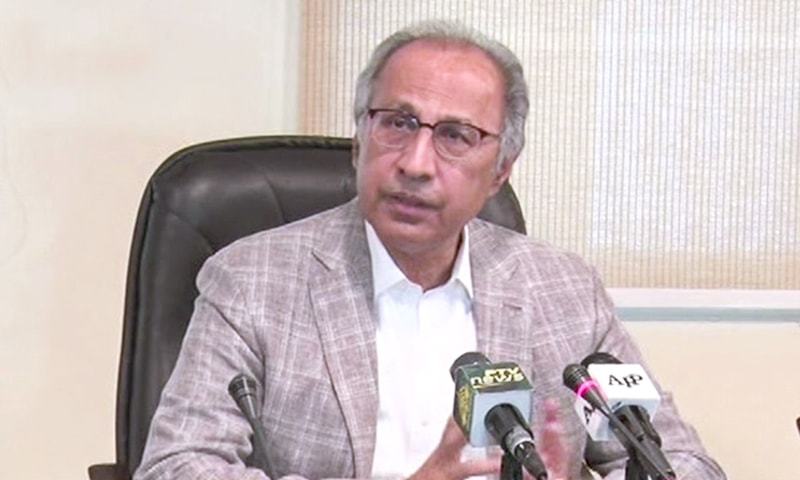

Adviser to the Prime Minister on Finance Dr Abdul Hafeez Sheikh on Wednesday discussed the measures that the government is taking in order to deal with the economic impact of the Covid-19 pandemic.

Addressing a press conference, Sheikh said that the pandemic is expected to have a negative effect on the country’s economy and outlined the various reasons why this would occur.

According to the premier’s special adviser:

- Demand for Pakistan’s exports will fall as the economies of the countries that it exports to are weakened

- Remittances from expatriates will be affected as countries where they are based, such as Saudi Arabia and the United Arab Emirates, are weakened

- Economic activity in Pakistan will also be reduced which will in turn reduce people’s income and taxes

Sheikh said that in Pakistan, the provinces have a lot of importance but currently both the provinces and the federal government are working together.

“There is an effort to created a united strategy in Pakistan,” he said.

The premier shared the key points of the Rs1.25 trillion economic package that had been announced by Prime Minister Imran Khan a day earlier.

- Rs200 billion designated for any labourer who loses his job or sees a reduction in employment opportunities which will be distributed after consultations with the business community and the provinces.

- Rs100bn tax refunds to export industry to provide them liquidity as soon as possible so that their work isn’t completely halted.

- Rs100bn to increase the activity and work of small businesses and the agriculture sector. Additionally, will try to reduce the price of fertiliser.

- Those who are affected or economically weak will be given Rs3,000 a month for 4 months; this will cover 12 million families.

- Five basic food items will be sold at lower prices at utility stores; Rs50bn will be given to utility stores for the purpose.

- 8.2million tonnes of wheat will be purchased by the government.

- Petrol, diesel etc prices will be reduced by Rs15 per litre and this value will be maintained.

- Lower electricity and gas consumers will be given time for payments.

- Additional Rs50bn for health workers’ equipment, uniforms and protection.

- Taxes on food products will either be completely removed or will be largely reduced.

- Rs50bn for National Disaster Management Authority (NDMA) ; further will be given if they require.

- Rs100bn fund for other demands of the business community.

- Financial monetary stimulus will also be given. Two big decisions in this regard are the reduction in the policy rate and if principle and interest are both due, then the business sector will be given three to six months to return it.