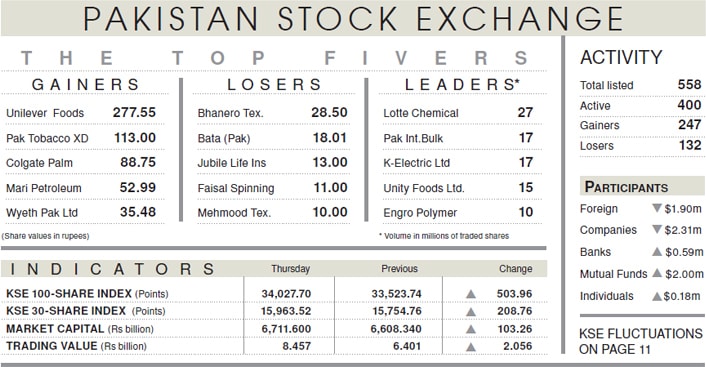

KARACHI: Bulls resumed the run-up at the stock market on Thursday after a day of breather, with the KSE-100 index posting strong gains of 503.96 points (1.50 per cent) to storm past the 34,000 level and settle at 34,027.70, marking a 63-session high.

The index touched intraday high by 523 points and mutual funds reversed roles with the foreign investors with the former purchasing stocks worth $2 million and foreign outflow of $1.90m.

The trigger behind the buying spree in stocks was decline in treasury yields in the latest treasury bill auction, where three-, six- and 12-months treasury yield fell four, 29 and 38 basis points, respectively.

Bond yields in secondary market further witnessed downward trend, indicating a possible rate cut in monetary policy over the next couple of months. Among banks, Habib, United and MCB closed in the green.

Investors’ confidence improved further by State Bank governor’s statement in which he indicated towards the macro stabilisation and success on external sector. Participants set aside the concerns over the Financial Action Task Force review and the rising political temperature.

Activity was observed across the board but mainly contributed by commercial banks and cement. Banks were the largest contributor to the index with 115 points, with exploration and production adding 74 points whereas expectation of further increase in cement price per bag kept investor optimism alive in the sector.

The volume increased 10pc to 261.1m shares, from 237.7m a day ago while trade value also rose by 32pc to $54m against $40.9m. Stocks that contributed significantly included Lotte Chemical, Pakistan international Bulk Terminal, K-Electric, Unity Foods and Engro Corporation, forming 33pc of the total turnover.

Major gainers were Lucky Cement, up 3.99pc, United Bank 2.06pc, Habib Bank 1.52pc, Pakistan Tobacco 4.90pc, Hub Power 1.94pc, Mari Petroleum 5pc, Habib Bank 0.89pc, Oil and Gas Development Company 1.57pc, MCB 1.60pc, Dawood Hercules 2.74pc and Engro Corporation 1.19pc.